Supermarket strawberry prices rose by an average of 11 per cent during the 2022 British season while growers received zero increase in prices during the same time, new figures have shown.

The new data, released by trade body British Berry Growers, have raised concerns for the future of British strawberries as growers are already reducing what they are planting for next year in light of low prices.

Growers report that prices from supermarkets have failed to cover increased costs, including spending more on labour, storage, haulage, planting and farm maintenance.

It comes after Wicked Leeks reported recently that British blueberry growers are also giving up or reducing their acreage after not being able to compete with lower prices offered to supermarkets by Peruvian exporters, where the cost of labour is often much lower.

An inquiry from the competition watchdog, the CMA, found last week that the supermarkets have not been profiteering off suppliers by raising prices and retaining the profits. Industry insiders have suggested that prices for consumers have risen more quickly on fresh produce precisely because there is less margin for retailers on these items, while growers across all sectors, including apples, berries and tomatoes, are undeniably struggling due to low returns.

“The squeeze on the British berry industry, which faces rising production costs and flat returns from supermarkets, is seriously threatening the viability of the British berry industry,” said Nick Marston, chairman of British Berry Growers.

“If we don’t address this disconnect, British berry growers will start to reduce the numbers of berries they grow or go out of the industry completely, as they are unable to make a profit. None of us wants that, least of all consumers, who love buying and eating British berries.

A survey of growers represented by British Berry Growers in June 2023 found an eight per cent reduction in the number of strawberry plants being planned for 2024.

This is equivalent to an estimated 12 million fewer British strawberry plants and nine million fewer punnets.

Marston continued: “The estimated eight per cent drop in strawberry plants for 2024 raises alarm bells for our industry. While consumers will not feel the impact right now, it highlights the need for swift action to ensure the long-term sustainability of the industry.

“The berry category has historically experienced consistent growth, but growers’ profitability is at an all-time low. If returns from supermarkets continue to fail to address growers’ rising costs, an increasing number of growers will be forced to cut production, shift to exports, or consider growing other crops.”

Financially stretched growers will move to growing other crops or diversifying away from horticulture if they are unable to cover their costs, the organisation said. According to the same survey, UK growers plan to export four times as many berries in 2023 as they did in 2022.

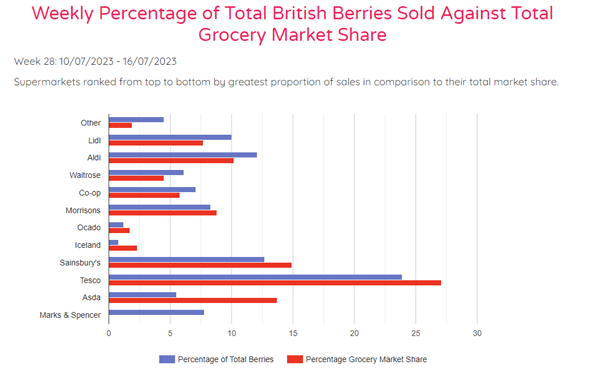

Britain is self sufficient in strawberries from May to October. British raspberries, blackberries and blueberries are in plentiful supply throughout the summer months. Despite that seasonal abundance, new figures show that supermarkets including Asda, Tesco and Sainsbury’s are buying less British berries than matches their market share and supplementing with imports.

Fresh berries are the most popular fruit item in the nation’s shopping baskets – accounting for the largest market share (28 per cent) of all fruit sold in the UK according to Kantar figures.

“We want to shine a light on retailer best practice and encourage consumers to challenge their supermarkets to stock British berries whenever possible,” added Marston.

0 Comments